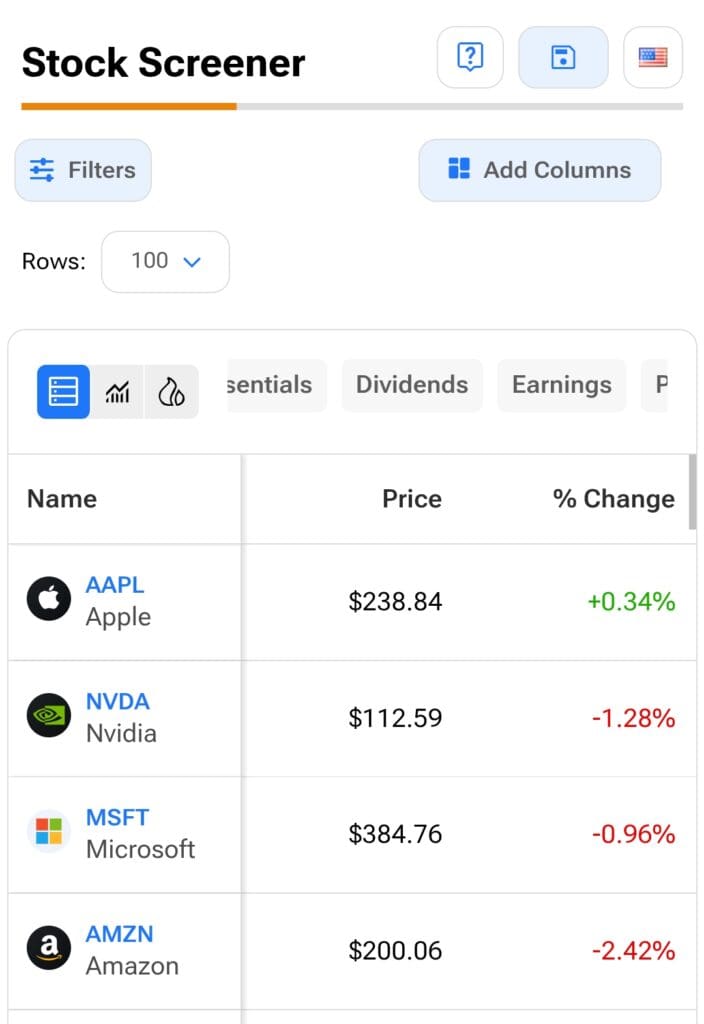

The TipRanks Stock Screener is an essential tool for investors looking to filter stocks based on specific criteria like market cap, performance, sector, and analyst sentiment.

It offers valuable insights without requiring a premium subscription, making it an ideal starting point for investors seeking to identify opportunities with basic, yet powerful filters.

Plan | Annual Subscription | Promotion |

|---|---|---|

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

How to Use TipRanks Stock Screener (Free Version)

TipRanks offers an intuitive stock screener with customizable filters, allowing users to find stocks based on various fundamental and sentiment-based criteria.

Though the free plan doesn’t offer access to advanced features like Smart Score and analyst ratings, it still delivers plenty of value for initial stock research.

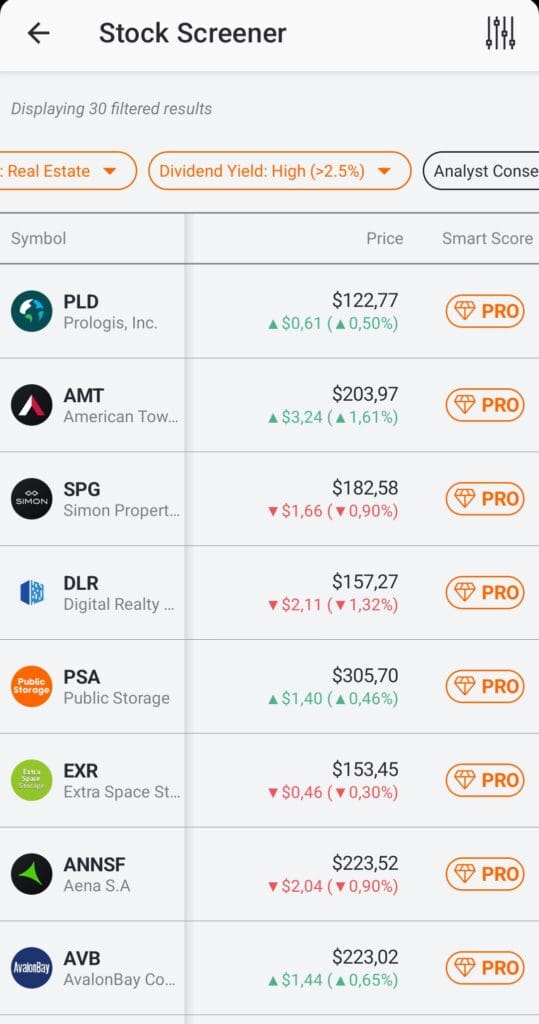

1. Dividend Screening

TipRanks’ free screener allows investors to filter stocks based on their dividend yield, helping income-focused investors build sustainable portfolios with dependable payouts. The free version highlights key data like dividend yield, growth trends, and payout ratio.

Dividend Yield: Filter stocks offering attractive dividend yields, perfect for generating income from your investments.

Payout Ratio: Use the payout ratio to assess a company’s ability to maintain its dividend payout, with lower ratios often signifying better long-term sustainability.

Dividend Growth: Identify stocks with a history of increasing dividends, which may indicate financial stability and a commitment to rewarding shareholders.

-

Find Dividend Stocks With TipRanks: Example

An investor seeking dependable income stocks with moderate risk might filter for:

Dividend Yield: 4%+

Payout Ratio: Under 60%

Dividend Growth: Positive over the past 3 years

This approach helps identify companies with strong yields and sustainable dividend growth.

2. Technical Indicator Screening

TipRanks offers basic technical screening tools, allowing users to filter stocks based on key momentum indicators. While the free plan is more limited than premium versions, it’s still valuable for those interested in technical analysis.

Moving Averages: Screen for stocks trading above their 50-day or 200-day moving averages, often indicating a bullish trend.

RSI Filter: Identify oversold (RSI <30) or overbought (RSI >70) stocks, which can signal potential buy or sell points.

MACD: Track momentum shifts and potential breakouts through MACD crossovers.

-

Technical Indicator Screening: Example

A swing trader wanting to capture momentum plays might filter for:

RSI: Between 40 and 60

Price: Above 50-day moving average

Volume: Over 500K shares

This filters for stocks with strong momentum and potential for breakout opportunities.

3. Debt and Liquidity Screening

TipRanks’ free screener helps investors evaluate a company’s financial health by filtering stocks based on key liquidity and debt metrics, crucial for assessing risk.

Debt-to-Equity Ratio: Screen for companies with low leverage, reducing exposure to risky businesses with high debt.

Current Ratio: Identify companies with sufficient short-term assets to cover liabilities, indicating operational strength.

Quick Ratio: A more conservative measure of liquidity that assesses a company’s ability to pay off short-term debt without relying on inventory.

-

Example

A risk-averse investor looking for financially stable companies might filter for:

Debt-to-Equity Ratio: Under 0.5

Current Ratio: Above 2

Sector: Technology

This helps reduce portfolio risk by focusing on companies that are well-positioned to weather economic downturns.

4. Growth and Value Investing Screening

TipRanks’ free stock screener enables investors to filter stocks based on growth and value metrics, perfect for those following either growth or value investment strategies.

Growth Filters: Use EPS growth, revenue growth, and forward P/E ratios to find stocks with strong expansion potential.

Value Filters: Target low P/E, P/B ratios, and undervalued stocks trading below their intrinsic value.

Hybrid Strategy (GARP): Combine growth and value criteria to discover “growth at a reasonable price” stocks, balancing long-term growth with fair valuations.

-

Example

A value investor looking for undervalued stocks might filter for:

P/E Ratio: Under 15

Revenue Growth: Positive

Market Cap: Over $2B

This approach helps find stocks that are undervalued yet have strong growth potential, ideal for value-oriented investing.

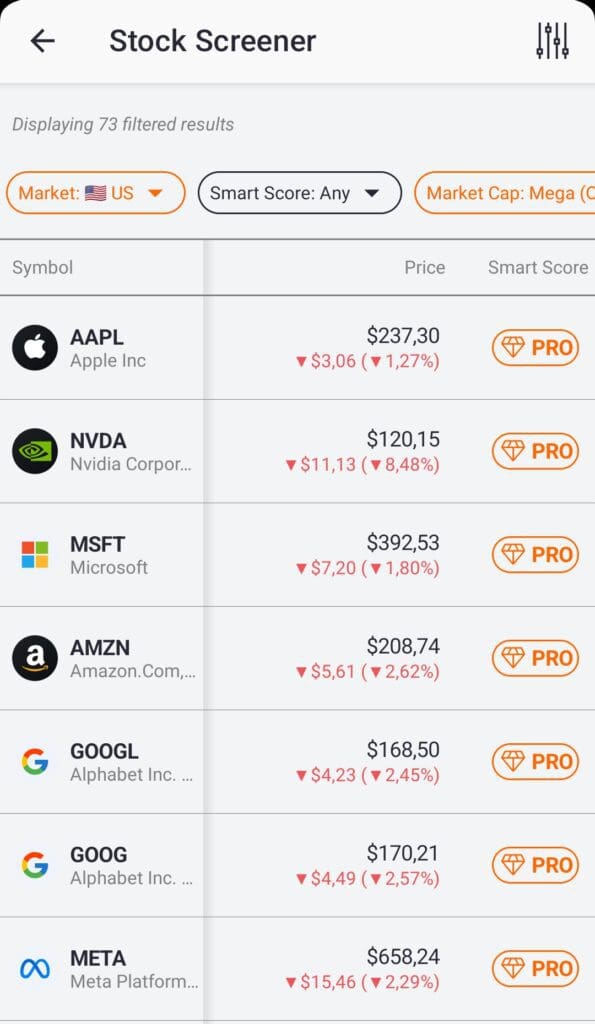

Best TipRanks Premium Stock Screener Features

TipRanks Premium and Ultimate unlock advanced screening features designed to help investors discover high-potential stocks through a combination of expert ratings, smart scoring, and sentiment data.

These tools go beyond basic filters by incorporating institutional activity, analyst performance, and insider sentiment.

1. Smart Score Stock Screener

As one of the top stock recommendations services, one of TipRanks’ most powerful premium features is the Smart Score, which rates stocks on a scale of 1 to 10 based on multiple signals, including analyst ratings, hedge fund activity, insider trades, and technical momentum.

Smart Score Filter: Focus on stocks rated 8–10, which are statistically more likely to outperform the market.

Multi-Factor Evaluation: Combines sentiment, fundamentals, and technical indicators into one rating.

Performance Insight: Prioritize stocks with improving smart score trends over recent weeks.

-

Find Stocks With Smart Score Stock Screener: Example

An investor aiming for strong long-term performers filters for stocks with a Smart Score of 9+, Market Cap above $5B, and analyst consensus rated “Strong Buy.”

This returns stocks with multi-layered bullish signals.

2. Analyst Consensus & Top Analyst Ratings

TipRanks Premium gives users deeper access to individual analyst ratings, including performance tracking and target price forecasts from top-ranked experts.

Top Analyst Filter: Screen stocks endorsed by analysts with the highest historical success rates.

Price Target Upside: Identify stocks with the highest upside potential relative to current price.

Success Rate Insights: Compare analysts based on accuracy and average return over time.

-

Example

An investor interested in high-conviction analyst picks filters for stocks with top analyst coverage, average price target upside over 20%, and strong buy consensus.

This can uncover undervalued stocks with strong expert backing.

3. Insider Transactions & Hedge Fund Sentiment Filters

Premium users can screen for stocks based on insider buying trends and institutional investor activity, giving insight into how well-informed participants are positioned.

Insider Buys Filter: Focus on companies with recent insider purchases by executives or board members.

Hedge Fund Sentiment: Highlight stocks with increased hedge fund ownership or new fund positions.

Combined View: Identify stocks with overlapping bullish signals from both insiders and hedge funds.

-

Example

An investor looking to mirror “smart money” sentiment screens for stocks with insider buys in the past 30 days, rising hedge fund activity, and a Smart Score above 8.

This can indicate growing institutional confidence.

4. Technical & Sentiment-Driven Screening

TipRanks Premium includes filters that blend technical signals and sentiment analytics, useful for traders looking to capitalize on short- to mid-term momentum.

Investor & Blogger Sentiment: Spot stocks receiving strong positive attention from the online community.

Technical Momentum Filters: Identify stocks with positive moving average trends and MACD crossovers.

News Sentiment: Screen for stocks trending positively in financial media coverage.

-

Example

A swing trader could screen for stocks with bullish blogger sentiment, strong MACD signal, and Smart Score over 8.

This supports momentum-based strategies with sentiment alignment.

FAQ

Yes, the screener supports several global exchanges, but advanced features like Smart Score or analyst ratings may be limited outside the U.S.

Yes, TipRanks' mobile app for iOS and Android includes screener functionality, though some features may be more limited than the desktop version.

Only premium and ultimate users can save and revisit custom screening setups. This helps users monitor specific investment strategies over time.

No, TipRanks does not offer real-time updates in the screener. Data may lag slightly depending on the feature, so it's better suited for swing or long-term investing.

TipRanks does not currently support ESG or sustainability-focused filters. Investors seeking these metrics may need to use external tools or platforms.

Yes, TipRanks Premium includes a penny stock screener that allows users to filter stocks under a specific price point with additional metrics like Smart Score.

TipRanks offers a dedicated ETF screener, allowing users to filter by asset class, focus, technical indicators, and other fund-specific metrics.

No, TipRanks does not support direct integration with brokerage platforms. However, users can manually track stocks and portfolios within the TipRanks ecosystem.